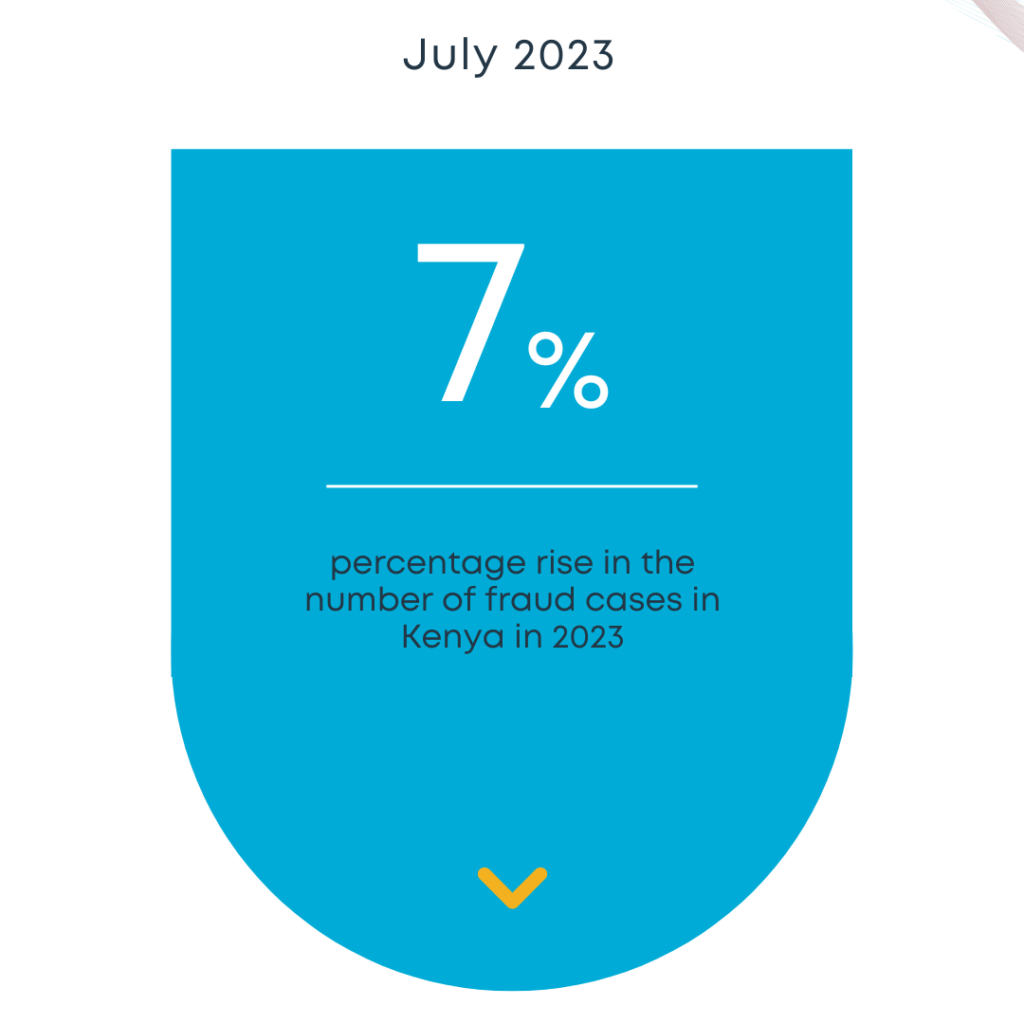

Most of us, if not all, have had someone politely call or message them asking for MPesa Refunds which often sound like, “Nancy, nimekutumia 5K kwa MPesa by mistake, naomba unirudishie.” (Nancy, I have erroneously sent you Kes. 5,000, kindly send it back) or “ Niko na mtoto hospitalini, ameumwa na nyoka. Please nitumie pesa kwa hii number” (My child is in hospital receiving treatment from a snake bite. Please send money to this phone number). There are so many examples to choose from but you already get the idea. Fraud has now become all too common for us but the real question is, have we set the right measures to protect ourselves? Is your personal data safe from fraudsters?

Kenya is top of the list this year when it comes to ID fraud in the wake of a new digital identity system that is scheduled to launch in September 2023. This research was published by Smile ID in comparison to countries such as Uganda, Rwanda, Tanzania, Ethiopia, Nigeria, South Africa, Ghana, Egypt, Zambia, Senegal, Cameroon, and Cote D’Ivoire. What is most concerning is that the national Identity Card is a crucial piece of identification for many Kenyans. It contains links to their bank accounts, health insurance, motor insurance, alien cards, and a long list of other government and private services. It is such cases of data insecurity that exemplify the need for heightened awareness on data protection in the country and beyond.

A pile of Kenya National Identity Cards: Image Credit

First things first. What is Fraud?

Fraud is an intentional use of false and misleading personal information about someone for personal gain be it financial or otherwise.

There are many types of fraudulent activities but the most common include Identity theft, bank fraud, insurance fraud, tax fraud and digital fraud.

- Identity theft involves using someone’s personal information such as their name, date of birth, location, to obtain a loan or extort money from them.

- Bank fraud on the other hand involves using fraudulent schemes to obtain money from a bank or a financial institution.

- Similar to bank fraud, insurance fraudsters use the same information to defraud people who have purchased insurance policies.

- Cyber fraud, also known as Digital Fraud is becoming the most common type of fraud. It is when criminals try to access your personal information through online platforms like websites, email, social media, dating sites among others, to trick you into giving them money.

How to protect your personal data from fraudsters

One of the biggest risks when it comes to fraud, especially in the AI era, is identity theft followed by financial loss where someone takes out loans in your name and never pays them back. While it’s not possible to completely eliminate fraud, you can take steps to protect yourself and limit exposure.

- Never give up personal information

Avoid leaving traces of your nakedness (personal data) in public places where fraudsters can easily access.

- Be on guard on the internet

Don’t click on suspicious “Free” wifi connections, links or open attachments from unknown websites and senders. Always use secure internet connections and ensure that all your online passwords are strong and contain a two step verification process.

- Avoid oversharing on social media

Don’t make it easy for identity thieves and hackers to attack your data. Avoid posting personal details of your home address, family members locations, and financial details. Be cautious and stay informed. They are watching.

- Keep your eyes open

Do you know your data rights?

Everyone has the right to keep their personal information safe and secure. Constantly educate yourself on data security and understand your data rights.

These rights are guaranteed under the Data Protection Act, 2019 that came into effect on 25 November 2019. You can also follow us on our social media pages to stay updated on all things #DataProtection.

#FichaUchi at all times. If you suspect that someone is using your personal information, quickly report the matter to the Office of the Data Protection Commissioner (ODPC) or the concerned institutions.